A Brief Overview of Budgetary Terms

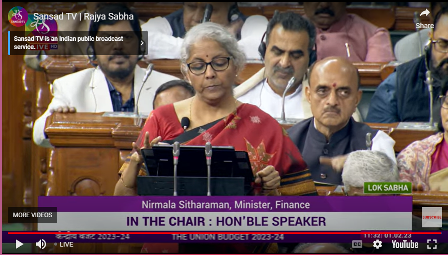

Today, the Budget for 2023–24 is presented. In this context, it would be useful to note some fundamental budgetary processes and facts.

fundamental budgetary processes and facts.

Origin: “Budget” is a widely used term, not only in parliamentary jargon but also in everyday language, to indicate financial management. It can be traced back to the late Middle English period, from the old French word “bougette,” a diminutive of bonge, a “leather bag,” from the Latin bulga, a leather bag, knapsack of Gaulish origin. The origin of the term budget can be traced back to the early 15th-century word bouget, which means leather bag, wallet, or pouch. In the mid-18th century, the Chancellor of the Exchequer’s annual statement in the British House of Commons was referred to as “opening the budget.” In the late 19th century, the term was also applied to non-government finances.

In India, the tradition adopted was that the Finance Minister would carry the Budget proposals to Parliament in a new briefcase. This convention continued until a few years ago when the Finance Minister of the National Democratic Alliance Government in 2014 carried the speech in a bag wrapped in red. This move was interpreted as symbolic of the Indian practice of ‘Bahi Khata, a traditional bookkeeping register with a red-coloured cover. This too has made way to the modern tablet, which reinforces Parliament’s march towards the adaptation of paperless and digital work systems.

Position in India: In the Constitution of India, the term Budget is not mentioned, instead, under Article 112, the term used is “Annual Financial Statement”. It states that the President shall, with respect to every financial year, cause to be laid before both Houses of Parliament a statement of the estimated receipts and expenditures of the Government of India for that year, and it has been referred to as the “Annual Financial Statement” in the said article. The term Budget has been taken as a synonym for “Annual Financial Statement”.

However, ‘Budget’ finds mention in the Rules of Procedure and Conduct of Business in Lok Sabha in Chapter XIX-Financial Business—Budget,” and in the Rules of Procedure and Conduct of Business in the Council of States (Rajya Sabha) in Chapter XV.

Presentation of Budget: Till 2016, the Budget was presented to Lok Sabha in two parts, the Railway Budget pertaining to Railway Finance and the General Budget which presents an overall picture of the financial position of the Government of India, excluding the Railways. Since the financial year 2017–18, Railway Budget was merged or subsumed with the General Budget, and now a single document titled ‘Union Budget’ is presented by the Minister of Finance.

Timings of Presentation of Budget: The practice of presenting the budget at 1700 hours began during the colonial era due to the time difference between New Delhi and Westminster, England. India is four hours, and thirty minutes ahead of British Summer Time. The custom of presenting Budget proposals in the evening ensured that the day in London began on time.

During the government of Prime Minister Atal Bihari Vajpayee’s National Democratic Alliance, the then-Finance Minister Yashwant Sinha proposed that the time be advanced to 1100 hours, the time when both Houses of Parliament begin sitting, as opposed to the British India-era custom. The new schedule was made so that announcements and numbers could be better analysed and there would be enough time for a well-informed budget debate.

Finance Minister Sinha wrote to the Speaker of Lok Sabha and the Chairman of Rajya Sabha to drop the tradition of Question Hour on the day, and for the first time in the history of the Indian Parliament, the Budget was presented on February 27, 1999, at 1100 hours.

This practice was also altered when the 2017-18 budget was presented on February 1. The goal was to ensure that the Budget was passed before the end of the fiscal year so that the new proposals could be implemented on April 1, the beginning of the new fiscal year.

Constitutional Provisions: The passage of the Budget is an elaborate, stage-by-stage process. In fact, the provisions relating to the budgetary process are laid out in the Constitution itself. These are under various provisions.

- Article 112 – Annual Financial Statement

- Article 113 – Demands for Grants

- Article 114 – Appropriation Bill

- Article 115 – Supplementary additional or excess grants

- Article 116 – Vote on Account

These are to be read with relevant provisions in the Rules of Procedure.

Various stages of the Budgetary process

The various stages of the Budget and its passage, termed the Budgetary Process can be broadly classified as under:

- Presentation of Budget

- General discussion on Union Budget

- Consideration of Demands for Grants after the presentation of Reports by Departmentally Related Standing Committees

- Discussion on Demands for Grants

- Cut Motions – Disapproval of Policy cut, Economy cut and Token cut

- Guillotine

- Vote on Account

- Supplementary and Excess Demands for Grants

- Appropriation Bill

- Finance Bill

The budgetary process ends with the passage of the Finance Bill.

The Budget Session has two sections. Part-I of the Budget Session begins with the President of India delivering an address to both Houses of Parliament assembled in the Central Hall. The following day, both the Budget and the Finance Bill are introduced. The Prime Minister of India then responds to the Motion of Thanks in the President’s Address after two or three days of discussion. This is followed by a two- or three-day General Discussion on the Union Budget, after which the Minister of Finance responds to the debate. Part I of the Budget Session typically lasts approximately ten days. After that, there is a recess of approximately one month. During this time, the relevant Department-Related Parliamentary Committees examine the Demands for Grants submitted by various Ministries. The Department Related Standing Committees present their reports on Grant Requests in Part II. The Business Advisory Committee of the Lok Sabha discusses and approves the demands of a select number of Ministries. On a specified date, all outstanding Grant Demands are guillotined. The passage of the Appropriations Bill for Grant Requests follows this. The Finance Bill, which is a Money Bill, is then considered, debated, and passed. The procedure for the Finance Bill is identical to that of other Money Bills.

Budget Terminology: In the context of the passage of the budget, several budget-related terms are used. In a nutshell, the following broadly comprise budget terminology:

|

|

|||||

|

||||||

The Budgetary process is very complex and involves various procedural stages. The thrust of the present article is to give only a broad idea about the passage of the Budget expressed in simple terms.