Social Stock Exchange: Is India Ready?

Government should actively take steps not just in terms of creating SSE, but also providing necessary support, and establishing a culture of investing in social projects for social returns.

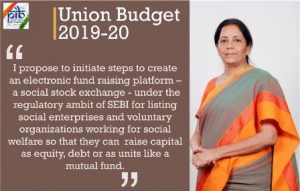

The Union Finance Minister, Nirmala Sitharaman, in her budget speech on 5 July 2019 proposed to establish a Social Stock Exchange (SSE). The Securities and Exchange Board of India (SEBI) constituted a working group chaired by Ishaat Hussain in  September 2019 to prepare a report on the same. The working group report was submitted on 1 June 2020, and is currently open for comments from stakeholders till 15 August 2020.

September 2019 to prepare a report on the same. The working group report was submitted on 1 June 2020, and is currently open for comments from stakeholders till 15 August 2020.

SSE is a novel concept with different variants across the world. For instance, Canada’s Social Venture Connexion, Singapore’s Impact Exchange and the UK’s Social Stock Exchange. SSE basically helps organisations working for social or environmental issues to channel resources for their cause. With SEBI’s working group report open for comments, stakeholders are voicing their concerns regarding the setting up of such an exchange in India and the kind of challenges that will arise in this undertaking. In this context, the Grassroots Research and Advocacy Movement (GRAAM) hosted a webinar “Can Social Stock Exchange (SSE) play a role in India’s Development? – A Global Perspective” on 25 July 2020.

Also Read : COVID-19 Calls for Reforms in International Migration Governance

In the webinar, Dr R Balasubramaniam presented GRAAM’s research report titled “Roadmap of Social Enterprise Ecosystem as a Precursor for a Viable Social Stock Exchange in India”, discussing the Social Enterprise (SE) ecosystem along with the challenges present in the Indian context for the establishment of an SSE. The other speakers in the webinar were Girish Joshi, Chief Trading Operations and Listing Sales, Bombay Stock Exchange (BSE), Hemanth Gupta, a member of the working group of SEBI and MD & CEO- BSE Sammaan CSR Ltd., and Dr Harsh Kumar Bhanwala, Ex-chairman of National Bank for Agriculture and Rural Development (NABARD). The research report by GRAAM is commissioned by NABARD.

Social Enterprise Ecosystem in India

The desk research conducted by GRAAM discusses the social enterprise ecosystem in India and presents a detailed analysis of the condition and gaps in the legal and policy infrastructure that pose a challenge on the growth of such enterprises.

On the basis of the findings, a roadmap for the implementation of SSE is suggested considering examples of global examples and stock exchanges in countries like the US, the UK, Canada and Singapore.

The GRAAM report explores and highlights the importance of creating a robust social enterprise ecosystem before establishing the SSE. Currently, Social Enterprise (SE) is an ambiguous entity without a clear legal definition. It is imperative to first establish SEs as legal entities with flexible forms like for-profit or non-profit with the condition of a primary focus on ‘social logic’ rather than‘profit logic’. A few global examples of SEs are Benefit Corporations (B-Corps) and Low-Profit Limited Liability Company (L3C) in the US, Community Contribution Company (C3) in British Columbia and Community Interest Company (CIC) in the UK.

Along with this lack of a definition, one major challenge is the lack of policy support from the government.For creating the desired ecosystem, active government participation is necessary. The Government of India has been extensively working on supporting Micro, Small and Medium Enterprises (MSMEs) through legislation and policies–MSME Development Act, 2016; National Skill and Entrepreneurship Policy, 2015; Alternate Investment Funds Regulation, 2012. A similar participation in the growth of SEs is necessary. The government should spread awareness, provide policy support, tax incentives at the starting up phase, resolve constraints to access funds, create frameworks of accountability, and valuation mechanisms for measuring impact.

Dr Bhanwala discussed the concept of impact and how it is defined and measured. He emphasised the importance of regulating and monitoring. With the establishment of the SSE, it will be imperative to have systems of measuring impact and NGOs will require assistance in terms of knowledge of finance. This is where organisations like NABARD come into the picture, which can help both for-profit and not-for profit organisations in capacity building.

Also Read : Intersection of Business and Human Rights from Various Perspectives

The report presents five requirements for a successful SSE: a) the demand side ecosystem; b) the supply side ecosystem; c) stock exchange infrastructure and intermediaries; d) leadership by the government; and e) and legal and regulatory frameworks. It also presents a roadmap along with learnings from the global examples.

United Nations Sustainable Stock Exchange

Speaking on the topic, Girish Joshi talked about the United Nations initiative of the Sustainable Stock Exchange. Like many other UN initiatives, this was established to achieve the Sustainable Development Goals (SDGs) through responsible investing. BSE is one of the first stock exchanges in Asia to sign this initiative and has introduced indices on the theme of sustainability like S&P Carbonex and S&P Greenex. The companies listed on the stock exchange are expected to make non-financial disclosures listing the steps they are adopting to improve their performance on environmental, social and governance (ESG) issues. The UN initiative promotes responsible investing and creates incentive for corporates to have better ESG practices.

Joshi explained how the UN Sustainable Stock Exchange can complement the SSE. For example, if big corporates work with vendors or suppliers on a contractual basis, they can invest in SEs to train vendors and suppliers on social and environmental issues to keep up with best ESG practices. If SEs are listed on the SSE, it will become easier for corporates to identify enterprises and direct their CSR funding towards them, and start-ups will also have easy access to funds. Joshi further elaborated on how having listed social enterprises can make it easier to hold corporates accountable and improve vigilance.

Joshi explained how the UN Sustainable Stock Exchange can complement the SSE. For example, if big corporates work with vendors or suppliers on a contractual basis, they can invest in SEs to train vendors and suppliers on social and environmental issues to keep up with best ESG practices. If SEs are listed on the SSE, it will become easier for corporates to identify enterprises and direct their CSR funding towards them, and start-ups will also have easy access to funds. Joshi further elaborated on how having listed social enterprises can make it easier to hold corporates accountable and improve vigilance.

SEBI and the Social Stock Exchange

Hemanth Gupta, being a member of the committee formed by SEBI to submit the report, gave insights into the committee’s understanding of SEs. He addressed the important question: why do we need SSE? He highlighted that the main challenge with the social sector remains that it does not create the reliability that a commercial stock exchange does because of the largely non-profit nature of the social development sector.

The idea is to create the discipline of a commercial stock exchange in social development investing and making investors more comfortable. For this, it is necessary that the organisations have adequate transparency.

Gupta also emphasised the advantages of a SSE. The dialogue around funding usually happens one-to-one; such an interaction imposes restrictions on the organisation in terms of the timeline of their project and the issue they can address. A SSE can remove such restrictions and the investment will depend on the organisation’s merit, impact and transparency. It will also have an implication on the scale of the projects, Gupta explained, as large-scale projects may attract more investments. This might push smaller organisations to collaborate and create large-scale projects. It is vital that larger organisations help smaller enterprises in taking advantage of the platform.

The need to tackle constraints faced by SEs in accessing funds and promoting both socially responsible investing in the corporate sector along with substantial investment in the social development sector is necessary to create impact. And SSE can be a tool in facilitating this, but the implementation challenges cannot be overlooked. The government should actively take steps not just in terms of creating SSE, but also providing necessary support and establishing a culture of investing in social projects not just for financial returns, but also for social returns. For this, it is important to induce the necessary ecosystem with incentives and starting necessary dialogues around such issues.

(The recorded video of the webinar can be accessed here ).