Special Status to states: The game of revenues

A flexible approach would strengthen the relationship between the Centre and states while maintaining the status quo.

Among many post-independence challenges, one of the serious issues is how to share revenues collected between the Union Government and the states. Though the Constitution of India lays down relevant sections to address the issue promptly, murmurs are reported periodically. The difference of opinions became prominent when the regional parties were different from the party at Centre, which started from the time of INC. Since then, the centre-state relation has become a contentious part of the political and legislative discourse. Sarkaria Commission was formed to look into those issues and measures including the setting up of a permanent inter-State Council were recommended. However, none were executed.

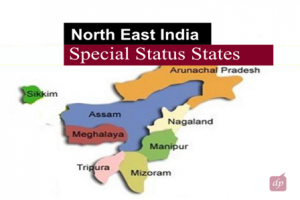

Amidst such a scenario, another development without any constitutional amendment was introduction of special status for a few states particularly for those which lacked resources like land, water and population to develop and grow – in particular, states in the Himalayan ranges.

Also read: Budget 2018: Beyond the promises of employment generation

During the Fifth Planning Commission in the period of 1969-1974, a formula drawn by S R Gadgil was accepted to divulge financial and tax concessions to such states.

Following a National Development Council’s resolution, a package under the Gadgil formula was accepted which was called Special Status.

“At present, 11 states enjoy special status and all of them are located in the Himalayan ranges. Apart from Jammu and Kashmir, all other states are under direct constitutional rule as J&K’s Article 370 provides special status to the state.”

Under the special status, states enjoy preferential treatment in getting central funds assistance; concession on excise duty to attract industries to the state; a significant 30 per cent of the Centre’s gross budget goes to the special category states; benefit of debt swapping and debt relief schemes and tax breaks to attract investment

Also read: GST – The Tax Designed Beyond Distortions

In the case of centrally sponsored schemes and external aid, special category states get it in the ratio of 90 per cent grants and 10 per cent loans, while other states get 30 per cent of their funds as grants.

The case of Special Category States and AP bifurcation

The Andhra Pradesh state was bifurcated and the new state called Telangana was formed after 60 years of their struggle. Earlier unified Andhra was renamed as Seemandhra. Under the bifurcation plan, erstwhile capital of unified Andhra, Hyderabad was to be handed over to the new state Telengana. Seemandhra was asked to build a new capital with assistance from the Centre.

However, Seemandhra was demanding Special Category Status to compensate the loss of nurtured capital and geographical locations to the new state. TDP which captured power in the subsequent election assured its electorate to get Special Category Status to boost its development. But that went into vain as the 14th Finance Commission refused to entertain such a demand since the basic features of such a special category does not fit the state. These features are hilly and difficult terrain, low population density, low resource base, strategic location along the borders of the country, economic and infrastructure backwardness, non-viable nature of the state’s finances and sizable share of the tribal population.

Hence the benefit has not been provided to Andhra. Besides it, Bihar, Goa and Odisha too demanded the status in the past.

Center’s response

The NDA Government under Modi was not offering a special package containing all the concessions provided under the status to AP because of withdrawal of such provisions by the Finance Commission. The TDP under N. Chandrababu Naidu did not accept the change and left the NDA. Now, it has taken the issue to the Rashtrapati Bhavan and handed over a memorandum to the President. Interestingly, the INC which did not give the status under Dr. Manmohan Singh extended (politically) opportunistic support to AP in the Rajya Sabha.

Do states lack financial independence?

It is widely argued that the Centre has taken all the taxing powers from the state. Even the GST regime left very few options for them to add financial resources on their own. As states came under the debt burden, are short of the stipulated 25 per cent of the SDGP threshold, and are forced to expand their Tax-GDP ratio to meet increasing outlays – they are facing a distressing situation.

“Therefore, a long-term solution has to be formulated. One immediate solution is to increase the state share from Central taxes up to 75 per cent from the current 42 per cent. In return, the Centre shall ask them to allocate funds for centrally-sponsored schemes.”

The Centre can also bring the liquor and fuel under the GST regime and formulate differential price mechanism to charge tax. For instance, higher provision of tax for guzzlers and large selling liquor varieties.

Even it may be left to the states to adopt tax slabs according to their prevailing state environment. Similar approaches could be extended to other items not so far brought under the GST. Beyond such attempts, the states can be allowed to adopt suitable policies towards subsidies and social welfare and freebie schemes. Such flexible approach would strengthen the relationship between the Centre and states. However, the Centre shall continue with stringent norms under Fiscal Responsibility and Budget Management Act, 2003 and other similar financial regulation regimes to keep states in check. This will ensure financial order and prevent states from mismanaging resources.