Rebuilding Kerala: A Cumbersome Task for the Government

The question that arises at this juncture is whether Kerala enjoys the fiscal space confirming a huge government investment considering that the Rs 6 lakh crore economy stands on Rs 2 lakh crore debt.

The aftermath of Kerala floods has given us some heart-breaking numbers. The state witnessed the worst natural calamity in a century, suffering grave infrastructure damage in particular. As per the rough estimate, deluge caused a loss of around Rs 20,000 crore to the economy with around 11,000 km of roads washed away, 237 bridges hit, 7,000 homes and 50,000 personal and government properties partially damaged.

Around six lakh people were affected by floods, which is two per cent of Kerala’s population. Now, it’s time to rebuild the state and the infrastructure requirement calls for mammoth capital expenditure from the State Government. The question that arises at this juncture is whether Kerala enjoys the fiscal space confirming a huge government investment. It should be stated here that the Rs 6 lakh crore economy stands on Rs 2 lakh crore debt.

Kerala contributes around five per cent to the GDP of the country with a GSDP (Gross State Domestic Product) of 6.1 lakh crore as per the Department of Finance, Government of Kerala’s 2018-19 Budget in Brief report. The state also tops in terms of per capita income and receives the highest share of remittances.

Also Read: Rebuilding Kerala: UN PDNA exercise to not count just damage, but rebuild better

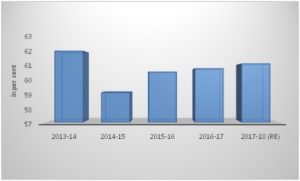

Nevertheless, when the fiscal indicators of the state are taken into account, the state does not hold a favorable position. In 2016-17, the fiscal deficit as a per cent of GSDP stands at 4.29 per cent which is above the target prescribed by the 14th Finance Commission.

“The total debt of the state stands at Rs 2.4 lakh crore, marking a per-capita debt of Rs 71,898.”

With its worsening fiscal indicators, it will be difficult for the government to finance such a gargantuan amount for post-flood development expenses. In such a scenario, it is important to understand the revenue and expenditure pattern of the government.

Revenue crunch is on its way

In 2017-18, the state saw a tax deficit of around Rs 4,000 crore, a huge gap from an estimated Rs 4,21,933 crore. For this fiscal year 2018-19, tax collection is estimated at Rs 46,795.68 crore, among which the government has been able to mobilise Rs 9,590 crore in the first quarter, which is only 20 per cent of the estimated tax collection. Maximum tax collection was expected in the second quarter with the festival of Onam falling in the month of August.

It is in the Onam season that maximum business happens in the state that reflects in the tax collection. For instance, in 2017-18, highest tax collection was marked during the Onam season in September at Rs 3,979.30 crore. The amount was more than 10 per cent of the total tax collected in 2017-18.

“Thus the floods have negatively affected consumption and brought in a huge loss to the businesses in the state, leading to lower tax collection in the second quarter in 2018-19 FY contrary to the expectation.”

In such a scenario, it will be difficult to meet the budget estimate with the government facing a revenue crunch in the 2018-19 financial year.

Composition of Expenditure

Kerala’s expenditure pattern shows that the committed expenditure occupies a larger share leaving less space for capital expenditure, whereas a huge capital expenditure is required for rebuilding the roads, bridges and for the infrastructural development of the state.

In 2016-17, expenditure on salaries, pensions, and interest payments had a share of around 73 per cent of the total revenue receipts of the state. For 2018-19, the estimated expenditure for salaries stands at Rs 32,996.38 crore as per the Budget, with government spending around Rs 2,750 crore monthly on salaries.

Breaking-down the fiscal deficit

When the deficit indicators are taken into account, fiscal deficit of the state is estimated at Rs 23,957.06 crore for the year 2018-19. Of the total fiscal deficit, revenue deficit has a share of around 53 per cent, which portrays the dominance of revenue expenditure.

Also Read: Kerala Floods: It is time to rethink about the Gadgil report says MLA Hibi Eden

For paying immediate compensation to the flood affected, the amount was estimated at Rs 408.66 crore, which could also add up to the revenue expenditure. The numbers clearly show that there is limited space for the government to fund capital expenditure after meeting its revenue expenditure.

“The amount mobilised through Chief Minister’s Distress Relief Fund (CMDRF) that crossed Rs 1,500 crore could only be sufficient to meet the immediate requirements of the state. The amount will be inadequate to cure the damage caused to the economy by the floods.”

Again, the borrowing of the government is also mainly to fund revenue expenditure rather than spending on the creation of capital assets. The debt to GSDP ratio of the state has crossed the limit of 25 per cent prescribed by the 14th Finance Commission at 30.2 per cent in 2016-17.

The figures illustrate difficulty for the government in mobilising resources from the market in the wake of floods. In general, the expenditure pattern of Kerala is highly depended on borrowing from the market. There has been a huge cry for infrastructure development in the state even before the floods.

Against this background, the government mooted the idea of Kerala Infrastructure Investment Fund Board (KIIFB) and the financing of KIIFB is also planned through market borrowing through the issuance of bonds. If KIIFB fails in repayment, it would add up to the debt of the state with the government being the guarantor of the bonds.

The huge loss caused by the flood to the state economy also displayed the helplessness of the Finance Minister in making the ends meet. The high share of committed expenditure viz. salary, pension, and interest payment is mainly due to the large size of the government. For instance, there are 121 departments under Government of Kerala with around five lakh employees. Similarly, Kerala has 96 working Public Sector Units (PSUs) receiving a high share of government funds. However, when the accumulated loss of working PSUs in the state is taken into account, it stands at Rs 3,136.8 crore. The situation calls the need for a huge correction in the expenditure pattern of the state.